Land Loan Affordability | Buying a piece of land in the U.S. is a major step toward building your future—but getting the financing is often trickier than getting a standard mortgage.

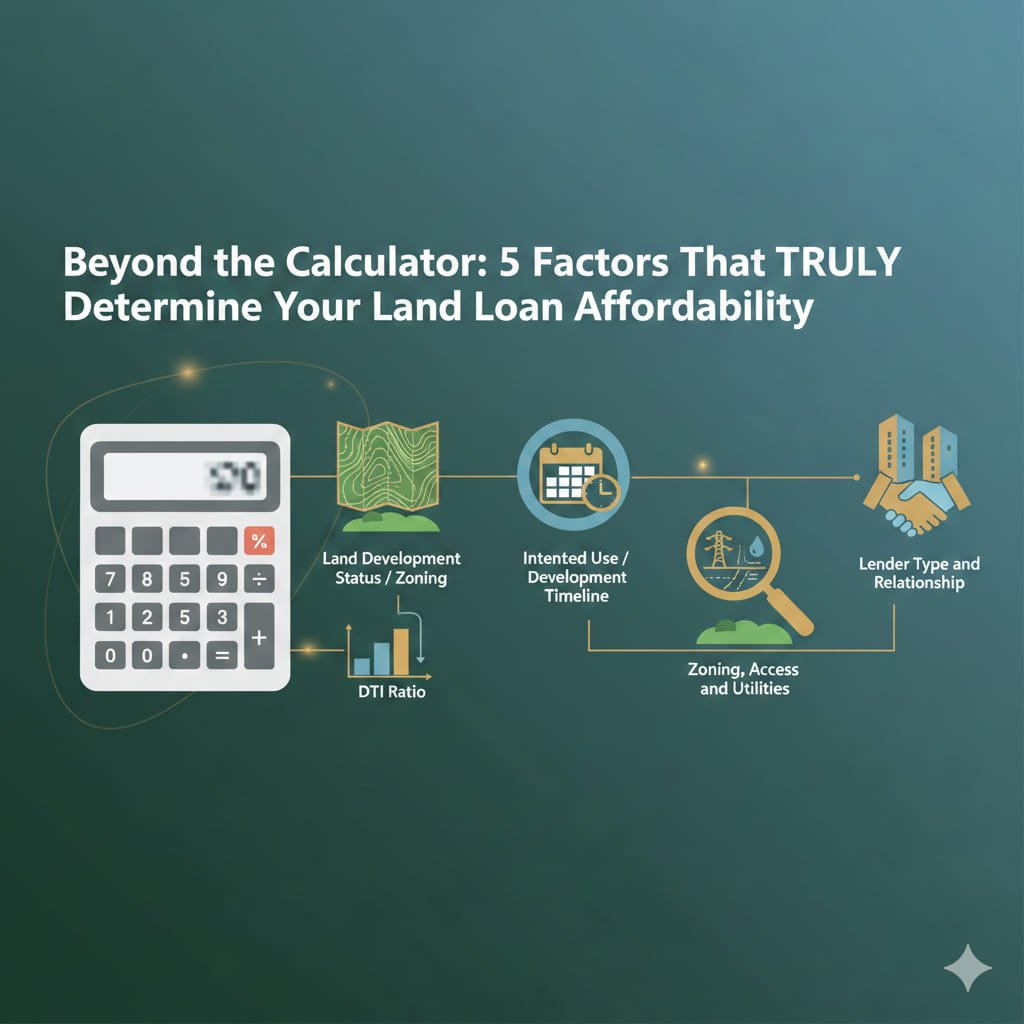

You can plug numbers into a land loan calculator all day, but the final, true cost of your loan hinges on five critical factors that the calculator doesn’t show. Lenders view raw land as a greater risk than a developed home, so they scrutinize these details to determine your actual interest rate, down payment requirement, and loan approval.

If you want to move from an estimated payment to a confident closing, you need to understand the true levers of land loan affordability.

1. The Land’s Development Status (Raw vs. Improved)

This is the single biggest factor influencing the lender’s risk and, therefore, your loan terms. The riskier the land, the harsher the loan terms.

Types of Land and Loan Impact:

| Land Type | Description | Loan Impact (Interest Rate & Down Payment) |

| Raw Land | Completely undeveloped. No utilities, roads, or septic approval. | Highest Risk. Requires the highest down payment (often 30%-50%) and the highest interest rates (often 1-3 percentage points higher than an improved lot). |

| Unimproved Land | Has some basic access (like a dirt road) but still lacks utilities. | Medium-High Risk. Down payment usually 20%-30% with shorter repayment terms (5-15 years). |

| Improved Lot | Ready to build. Paved road access, water, sewer/septic, and power available at the lot line. | Lowest Risk. Terms are closest to a mortgage, often requiring a down payment of 15%-25% and offering better rates. |

Affordability Insight: If you target raw land, you must budget for a significantly higher upfront cash payment and a higher monthly EMI due to the interest rate premium.

2. Your Total Debt-to-Income (DTI) Ratio

While your credit score focuses on your past behavior, your DTI ratio focuses on your current financial capacity—and lenders for land loans take a hard look at it.

Your DTI is the percentage of your gross monthly income that goes toward paying all your monthly debts (mortgages, car loans, credit cards, etc.).

- The Land Loan Threshold: For a land loan, lenders typically want to see a DTI ratio of 43% or lower. The lower your DTI, the more financial margin you have, which signals lower risk to the bank and can qualify you for a better interest rate.

- Actionable Tip: Paying down a high-interest credit card balance before applying is one of the quickest ways to instantly improve your DTI and, consequently, your affordability.

3. The Intended Use & Development Timeline

A bank needs to know what you plan to do with the land and when. Unlike a home, which is collateral they can easily resell, raw land is difficult collateral. Your plan dictates the lender’s risk exposure.

| Intended Use | Lenders’ View | Affordability Impact |

| Immediate Construction | Lower Risk. You have a concrete plan and may use a lower-interest construction loan that converts into a standard mortgage (a Construction-to-Permanent Loan). | Better rates and terms, often lower down payments. |

| Holding for Investment | Highest Risk. The land may remain vacant for years, delaying the bank’s security. | Expect the strictest terms, highest down payments, and shortest terms (often 5-10 years). |

| Agricultural/Farm Use | Specialized Risk. Requires specific knowledge from the lender (Farm Credit or local community banks). | Rates are competitive but terms are specific to agricultural practices and revenue projections. |

Important: Have a detailed plan, including estimated building dates or a business model (for farm use), ready for your loan officer. A solid plan is often as valuable as a few points on your credit score.

4. Zoning, Access, and Utility Availability

Your loan amount is based on the appraised value of the land. A property that is hard to access or impossible to use as intended is worth less to the bank and is, therefore, a greater risk.

- Zoning Restrictions: Is the land zoned residential, commercial, or agricultural? If you want to build a house on commercially zoned land, the loan won’t happen. Always verify zoning and local ordinances before you apply.

- Legal Access: Does the land have legal, recorded access to a public road via an easement or road frontage? Lack of legal access makes the land extremely hard to finance.

- Utilities: The closer the land is to existing utilities (water, sewer, electric), the easier the financing. If you have to pay $50,000 to run a sewer line a quarter-mile, that cost effectively makes the land less affordable and your loan riskier.

Expert Tip: Request a Title Search and boundary survey early in the process. Unforeseen issues discovered here can derail your loan or change your required down payment.

5. Lender Type and Relationship

Not all banks offer land loans, and those that do treat them differently. Your choice of lender significantly impacts your final affordability.

- National Banks: Often have rigid, high requirements and may only finance improved lots.

- Local/Community Banks & Credit Unions: Often understand the local market and the value of specific parcels better. They may be more flexible on terms, especially if you have an existing banking relationship.

- Farm Credit System: Specializes in large tracts of rural and agricultural land, offering competitive rates for specific uses.

The Bottom Line: Your loan officer’s discretion is often wider for a land loan than a standard mortgage. Shop around and leverage any existing relationship you have for the most favorable terms.

Calculate Your Starting Point

While the five factors above dictate your final approval and rate, every good financial plan begins with an estimate.

Use our Land Loan Calculator to model scenarios based on different interest rates, down payments (30%, 40%, 50%), and terms (10 years vs. 15 years). This will give you a clear baseline before you bring in the complex variables of land type and DTI.

➡️ Click here to get started with our Land Loan Calculator today!