Unlocking the Mystery of Land Loan Affordability

Land loan Payments | Buying land in the U.S. is a fantastic investment, whether you plan to build your dream home, start a farm, or simply hold an asset that appreciates. But unlike a standard mortgage, calculating your monthly payment for a land loan can feel like guesswork. Many prospective buyers underestimate the costs, the terms, and the true financial commitment.

This definitive guide will demystify the process. We’ll show you the exact formula lenders use, the critical factors that drastically change your payment, and provide a clear, step-by-step method to accurately calculate your land loan EMI (Equated Monthly Installment).

🔑 Key Takeaway: The payment for a raw land loan often involves shorter terms and higher down payment requirements than a traditional home mortgage. Knowing how to calculate it is the first step toward smart land ownership.

Land loan Payments | Ready to Skip the Manual Math?

While we’re diving deep into the calculations, remember that the fastest and most accurate way to get your monthly payment is by using a dedicated tool.

➡️ Use our Land Loan Calculator now to model different scenarios and instantly see your monthly EMI!

Step 1: Understand the Key Variables (The ABCs of Loan Calculation)

Every monthly loan payment is determined by three fundamental variables. Understanding these is crucial for using any calculator correctly and knowing how to negotiate your best rate.

A. Principal (P): The Actual Loan Amount

This is the amount of money you are borrowing. For land, the Principal is determined by subtracting your down payment and any closing costs you pay upfront from the total purchase price.

- Crucial Difference: Land loans typically require a higher down payment—often between 20% to 50% of the appraised value, significantly impacting your Principal.

B. Interest Rate (r): The Cost of Borrowing

This is the annual percentage rate (APR) charged by the lender. You must convert this annual rate into a monthly rate for the calculation.

- Example: If your Annual Interest Rate is 7.5%, your monthly rate (r) is 7.5% / 12 = 0.00625 (as a decimal).

C. Loan Term (n): How Long You Have to Pay

This is the length of the loan in months. Land loan terms are generally much shorter than the 30-year terms common for home mortgages.

- Typical Terms: Land loans often range from 5 to 15 years (60 to 180 months).

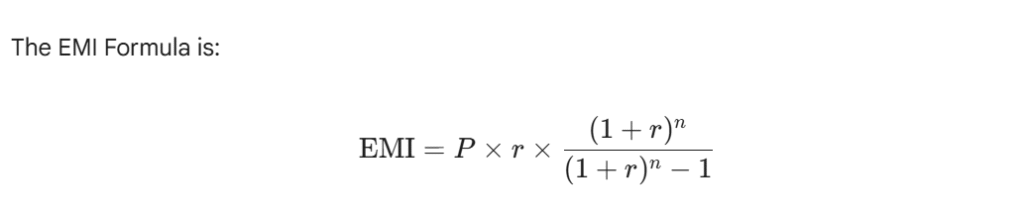

Step 2: The Land Loan Calculation Formula Explained

Lenders use the Equated Monthly Installment (EMI) formula to calculate your payment. While complex to do by hand, knowing the components helps you appreciate the impact of a rate change or down payment increase.

- P = Principal Loan Amount

- r = Monthly Interest Rate (Annual Rate / 12)

- n = Loan Term in Months

⚙️ Practical Example: Putting the Formula to Work

Let’s say you are buying a parcel of land for $100,000 and secure a loan:

| Variable | Value | Notes |

| Purchase Price | $100,000 | |

| Down Payment (25%) | $25,000 | |

| Principal (P) | $75,000 | $100,000 – $25,000 |

| Interest Rate (Annual) | 7.00% | |

| Monthly Rate (r) | 0.005833 | 7.00% / 12 = 0.5833% |

| Loan Term (n) | 15 Years (180 months) |

Plugging these into the formula yields a calculated Monthly EMI of $674.20.

Action Step: Use the example above and check it against the results of your Land Loan Calculator to see how quickly you can model the payment!

Step 3: Beyond the Calculator — 3 Factors That Truly Impact Your Rate

A calculator is only as good as the information you feed it. To secure the lowest rate and lowest payment, you need to address these three variables that lenders scrutinize.

1. The Land’s Status (Raw vs. Improved)

The risk to the lender changes based on the type of land:

| Land Type | Description | Payment Impact |

| Raw/Unimproved | No utilities, power, or road access. | Higher Rate & Down Payment. The land is harder for the bank to sell if you default. |

| Improved/Developed | Ready to build (has utilities, sewer/septic approval, access). | Lower Rate & Down Payment. Lower risk for the lender. |

2. Your Credit Score (The Rate Decider)

Your credit score is the single biggest determinant of your interest rate (r).

- Aim High: Lenders typically look for a minimum score between 650 and 700 for land loans, but the best rates are reserved for scores above 740. A low score could add one or two percentage points to your rate, significantly increasing your EMI over the loan’s term.

3. Total Loan Costs (Fees You Can’t Ignore)

The final “true cost” of your loan includes one-time closing costs that aren’t part of the Principal (P). These typically range from 2% to 5% of the loan amount and include:

- Appraisal Fees (Crucial for land)

- Title Insurance and Search Fees

- Origination and Underwriting Fees

Pro Tip: While these don’t affect your monthly EMI, they dramatically increase your cash required at closing. Always factor these into your budget!

Step 4: Using Your Calculator to Find Your Sweet Spot

The power of an accurate land loan calculator is that it allows you to easily stress-test your budget by adjusting the variables.

Scenario Modeling Examples:

| Scenario | Principal (P) Change | Interest Rate (r) Change | EMI Impact |

| Increase Down Payment | Decreases | Neutral | Lowest EMI |

| Improve Credit Score | Neutral | Decreases | Significant EMI Reduction |

| Shorten Term (n) | Neutral | Neutral | Higher EMI / Less Total Interest Paid |

By running these scenarios on the Land Loan Calculator, you can quickly find the combination of down payment, term, and rate that keeps your monthly payment comfortable and affordable.

Final Thoughts: Land Loans are an Investment

Calculating your land loan payment accurately is more than just crunching numbers; it’s about confidently making a major financial decision. By understanding the formula and the factors that influence your rate and term, you take control of your investment.

Take the Next Step

Now that you know the method, it’s time to find your exact payment.

Click here to use the most accurate Land Loan Calculator and confidently determine your monthly EMI today!